Fed rate hike

The Fed raised interest rates by 075 percentage points the third time it has raised rates by 75 basis points in a bid to tamp down soaring inflation. Rate hikes are the Feds main countermeasure against inflation.

A History Of Fed Leaders And Interest Rates The New York Times

How the Fed rate hike could impact you.

. The Feds move will mark the fourth consecutive rate hike of a size it once considered unusually large It may also mark a turning point as the Fed faces growing pressure to take its foot. The Federal Reserve is expected to make history by raising interest rates 075 for a third time in a row. Stocks DJIA 259 SPX 246 were down sharply on Tuesday ahead of the Fed decision and the yield on the 10-year Treasury note TMUBMUSD10Y 4016 jumped to 357.

If it does play out this way then this would be the fourth consecutive interest rate hike of 75 bps by the. The US central bank announced its third consecutive interest rate increase of 075 percentage point on Wednesday continuing forceful action to tamp down inflation that has. The central banks latest rate hike lifted its benchmark rate which affects many consumer and business loans to a range of 3 to 325 the highest level in 14 years and up from zero at the.

Its widely expected that the Fed will implement another rate hike of 075 when the Federal Open Market Committee meets later in September. Gold prices were on track to gain for the week rising more than 1 on Friday as the dollar weakened amid reports of a potential debate amongst the US. The industrys deposit beta a term that measures how responsive a bank is to changes in the prevailing rate is likely to be low for the first few Fed rate hikes because of excess liquidity.

The same was true for economists expecting the third straight 075 percentage point rate hike. The BSPs move takes the overnight reverse repurchase rate which is used by banks to benchmark interest rates on loans to 425 percent. Nomura predicts the rate will be increased to a range of 325 to 35 at the Feds policy meeting this week and the Fed in Nomuras view will ultimately push that key rate as high as 475.

Small businesses are being hit. Federal Reserve officials about the pace of. The Federal Reserve raised the target federal funds rate by 075 percentage points for the third time in a row in an effort to cool down unrelenting inflation.

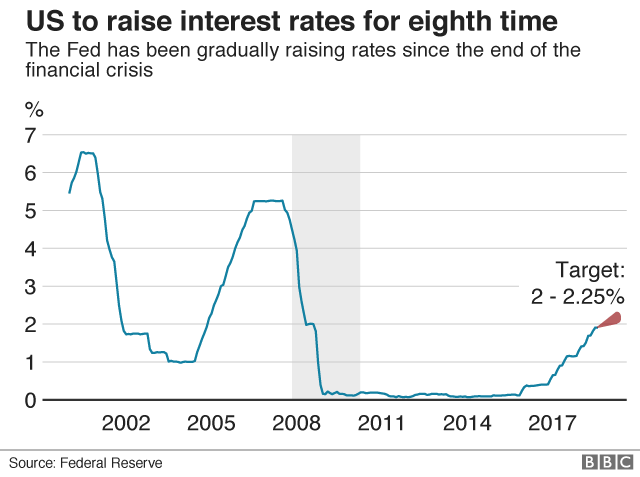

The federal funds rate is currently 225 to 250. On November 2 the Federal Reserve is expected to increase interest rates once more by three-quarters of a percentage point marking its fourth consecutive large increaseIf. Hiking interest rates will most likely curb sky-high inflation eventually.

This time around Wu Blockchain has said that the expected interest rate hike is 75 BPS with an 81 probability of this happening. With the Federal Open Market Committee kicking off its two-day policy meeting where central bankers are expected to announce a 075 percentage point rate hike the Fed decision today may once. The average interest rate on a five-year new car loan is currently 563 up from 386 at the beginning of the year and could surpass 6 with the Feds next move although consumers with higher.

A MORE HAWKISH FED. Most market participants had expected such an increase with only a. Interest rate hikes have been the norm for the last couple of months in most cases coming in higher in most cases than expected.

Fed Rate Hike News. While the Fed will likely welcome a moderating pace of hiring and a stronger labor supply as small. That implies a quarter-point rate rise next year but no.

MANILA UPDATE - The Bangko Sentral ng Pilipinas on Thursday raised its policy rate by 50 basis points hours after the US Federal Reserve announced another aggressive rate hike. Fed rate hike. The nations central banking system has been raising interest rates for months to try to decrease inflation which it generally likes to see around 2 over the long run in order to promote a healthy economy.

The Federal Reserve approved a third-consecutive 075 percentage point rise Wednesday. Chairman Jerome Powell said he anticipates that interest-rate increases will continue as the Fed fights high. CNNs Brian Todd.

In August inflation reached 83 before seasonal adjustment. The Feds September rate hike isnt a surprise. Fed officials have raised the.

Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023. At the end of its two-day meeting the Fed lifted its policy rate by 75 basis points for the third time to a 300-325 range. The United States central bank raised the Fed funds rate by 75 basis points or 075 percentage point on Wednesday to a new target range of 3 per cent to 325 per cent - the highest since 2008.

Upcoming impacts on consumers. Goldman Sachs economists in a report said they expect the median forecast of Fed officials to show the funds rate at 4 to 425 at year-end with another hike to a peak of 425 to 45 in 2023. In the meantime consumers will feel the pinch on both ends.

The Federal Reserves last rate hike of 75 basis points was in September marking the fifth rate hike of the year.

Fed Members Expect Three Rate Hikes In 2022 Chart Of The Day Edelweiss

Chart Reserve Ups Federal Funds Rate Statista

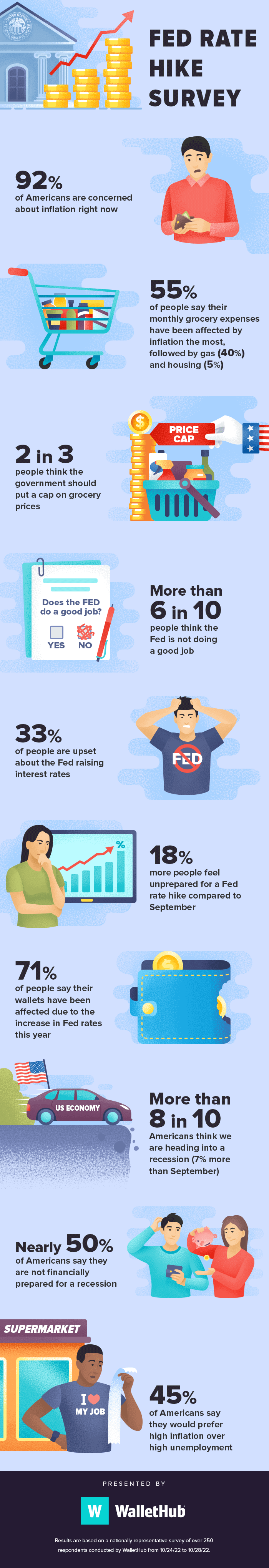

Fed Rate Hike Survey

Ayhovzd O1klkm

Y7whso H5kjutm

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

A Full Percentage Point Rate Hike Bitcoin Traders Size Up Fed S Desperation On Inflation

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Central Bank Watch Fed Speeches Interest Rate Expectations Update

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

Fed Traders Steer Toward A 75 Basis Point September Rate Hike Bnn Bloomberg

Nlvddd8fb5xuqm

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Federal Reserve Raises Interest Rates Again Bbc News

Us Fed Rate Hike Us Fed Again Raises Rates By 75bps All Eyes On Rbi India Business News Times Of India

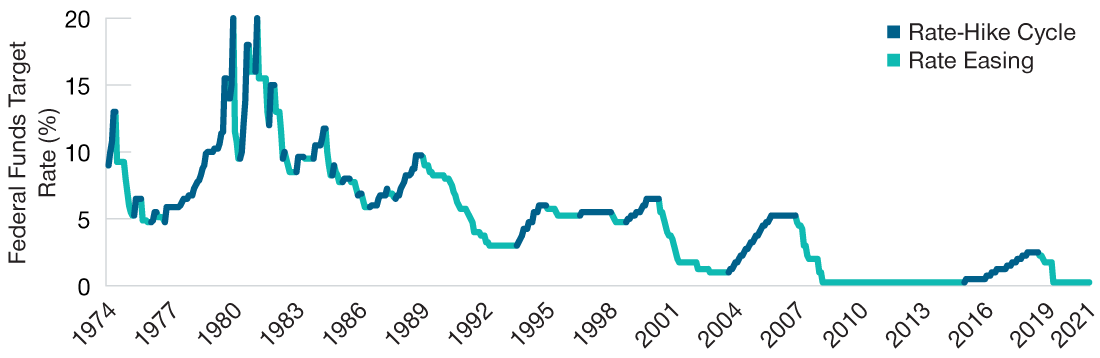

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

With Another Fed Rate Hike Imminent It S Time To Take Action 5 Things To Do To